Office Space Demand Forecast, Second Quarter 2023

Demand for Office Space Expected to Shrink Through Early 2024

By: Hany Guirguis, Ph.D., Manhattan College and Michael J. Seiler, DBA, College of William & Mary

Release Date: June 2023

The national office market experienced total negative net absorption of 21.3 million square feet through the fourth quarter of 2022 and the first quarter of 2023, bringing the vacancy rate to 17.8 percent, the highest level since the second quarter of 1993.1 The COVID-19 public health emergency officially ended in the United States on May 11, 2023, but remote and hybrid work arrangements remain largely in place and continue to negatively affect demand for office space.

A currently strong labor market is combining with fears of a looming recession to limit occupiers’ interest in signing new leases. With the unemployment rate at 3.4 percent,2 the lowest since 1969, the competition for talent is supporting the continuation of hybrid and remote work policies. Although a gradually growing share of employers are requiring employees to come into the office four or five days a week, three days remains the norm in many office-using industries, and a minority of employers require fewer days in the office or allow a large share of their employees to be fully remote. Average office occupancy across the 10 metropolitan markets tracked by Kastle Systems remains at only 49.9 percent.3 At the same time, few firms are interested in expanding the amount of space they lease as they prepare for a potential recession later this year. As a result, while office-using employment has risen to 5.4 percent above pre-pandemic levels, occupied office space is 3.5 percent below pre-pandemic levels, and the average amount of office space per employee has fallen to a 22-year low of 152 square feet.4

A recent study by CBRE has found that 80 percent of the total increase in vacancy between the beginning of 2020 and the end of 2022 has been concentrated in only 10 percent of office buildings, suggesting that the functional obsolescence of a relatively small share of buildings is also contributing to higher vacancy rates.5 Until these buildings are retrofitted, repurposed or demolished, a surplus of obsolete space will likely pose a headwind for the broader office market. High interest rates have slowed office deal volumes and will likely limit the number of retrofit and conversion projects this year.

It remains to be seen how an actual recession might reshape the dynamic around hybrid and remote work. In the short term, however, a recession would weaken demand for office space. Weakness in the tech sector, for example, has led to layoffs, further suppressing demand for office space in several metro areas and contributing to an increase in the availability of subleased space, with technology firms now accounting for 23 percent of all sublease availability.6

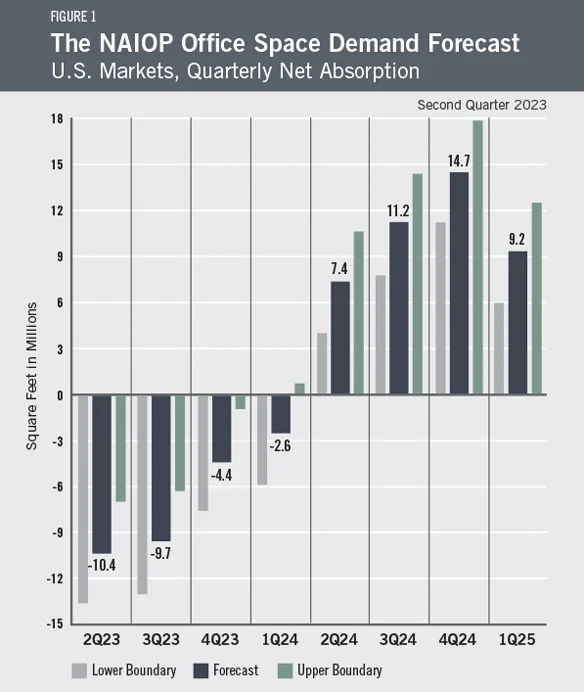

Given these trends, net office space absorption in the remaining three quarters of 2023 is expected to be negative 24.4 million square feet. Moving forward, the forecast projects that net absorption will turn positive in 2024 and will total approximately 30.6 million square feet for the year (Figure 1).

Read the Full Study

Download the Full Report

Authors

Hany Guirguis, Ph.D., Professor, Economics and Finance, Manhattan College

Michael J. Seiler, DBA, J.E. Zollinger Professor of Real Estate & Finance, College of William & Mary

Media Inquiries

Please contact Kathryn Hamilton, CAE, vice president for marketing and communications, at hamilton@naiop.org.

1 CBRE, Market Fundamentals data as of Q1 2023.

2 U.S. Bureau of Labor Statistics, “Employment Situation Summary,” news release, May 5, 2023, https://www.bls.gov/news.release/empsit.nr0.htm.

3 Kastle Systems, “Kastle Back to Work Barometer,” May 8, 2023, https://www.kastle.com/safety-wellness/getting-america-back-to-work/.

4 CBRE, “Disconnect Emerges Between Office Job Growth & Office Demand,” March 15, 2023, https://www.cbre.com/insights/briefs/disconnect-emerges-between-office-job-growth-and-office-demand.

5 CBRE, “Office Buildings Hardest Hit by Pandemic Share Common Characteristics,” April 4, 2023, https://www.cbre.com/insights/viewpoints/office-buildings-hardest-hit-by-pandemic-share-common-characteristics.

6 CBRE, “U.S. Office Sublease Availability Nearly Doubles Since Pandemic,” April 20, 2023, https://www.cbre.com/insights/briefs/us-office-sublease-availability-nearly-doubles-since-pandemic.